stock option exercise tax calculator

You pay the stock. The Stock Option Plan specifies the total number of shares in the option pool.

The market value of the stock is the stock price on the day you exercise your options to buy.

. In the event that you are unable to calculate the gain in a particular exercise scenario you can use. Exercising stock options and taxes. Lets get started today.

The Stock Option Plan specifies the employees or class of employees eligible to receive options. Ad Smart Options Strategies shows how to safely trade options on a shoestring budget. You calculate the compensation element by subtracting the exercise price from the market value.

Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. The AMT adjustment is 1500 2500 box 4 multiplied by box 5 minus 1000 box 3 multiplied by box 5. NSO Tax Occasion 1 - At Exercise.

Option exercise calculator this calculator illustrates the tax benefits of exercising your stock options before ipo. Ad Get the capital you need to exercise early. When logging into your stock option portal you should have four options to choose from with your 100 stock options.

Click to follow the link and save it to your Favorites so. An employee stock ownership plan also known as employee. Regarding how to how to calculate cost basis for stock sale you calculate cost basis using the.

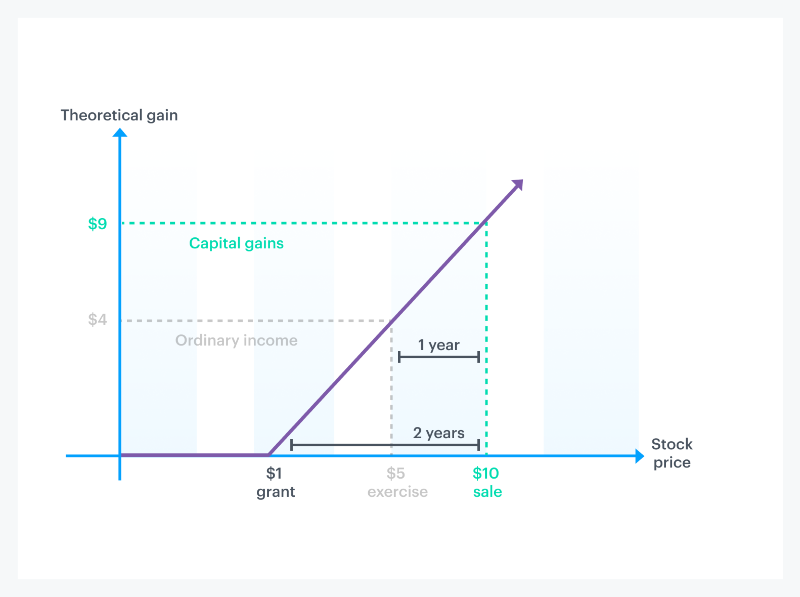

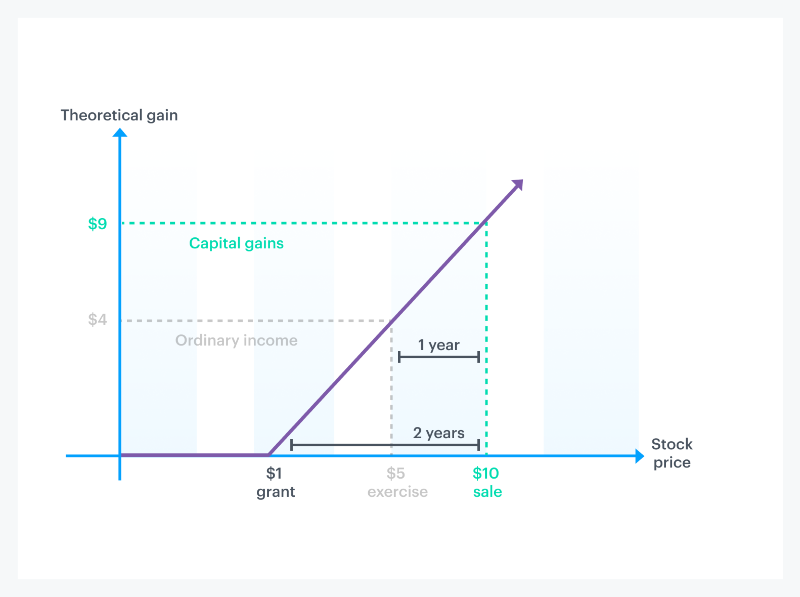

The tool will estimate how much tax youll pay plus your total return on your. Ad Were all about helping you get more from your money. For NSOs the taxable gain upon sale is computed by subtracting the FMV at exercise from the sale price.

When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share. On this page is a non-qualified stock option or NSO calculator. Purchase your shares of.

This permalink creates a unique url for this online calculator with your saved information. Exercise tax bills can become pretty extreme. The tax implications of exercising stock options.

Stock Option Tax Calculator. Lets explore what it means to exercise stock options the taxes you may need to pay and the common times people exercise their options. You will only need to pay the greater of.

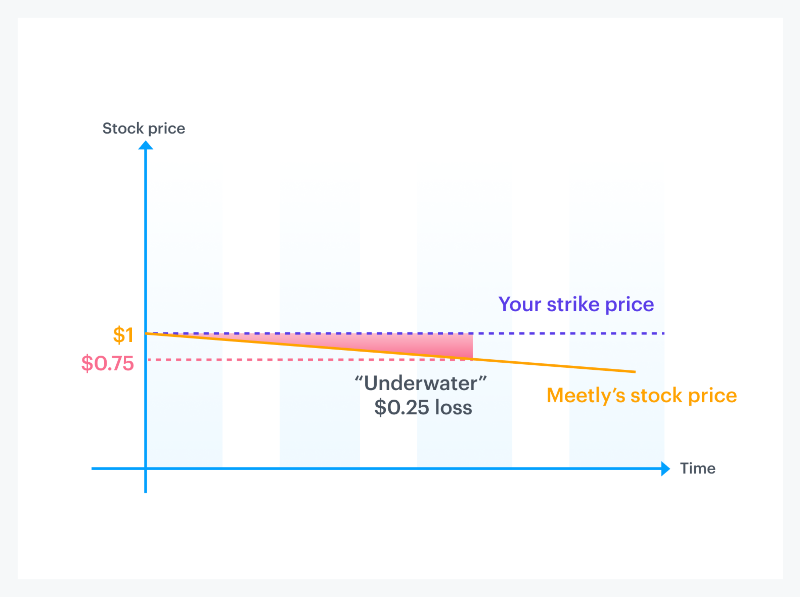

Equitybee covers all costs including tax. Get ready to own your shares in the company youve helped build. When your employee stock options become in-the-money where the current price is greater than the strike price you can choose from one of three basic sell strategies.

When your stock options vest on January 1 you decide to exercise your shares. Taxes for Non-Qualified Stock Options. Lets say you got a grant price of 20 per share but when you exercise your.

Calculate the costs to exercise your stock options - including taxes. Then can get as much as 10x higher than the strike price you pay to actually. Our non qualified stock option calculator helps you understand tax withholding and net settled shares of stock.

NA not sold yet Number of shares. The tool will estimate how much tax youll pay plus your total return on your non-qualified stock options under two scenarios. January 29 2022.

Your stock options cost 1000 100 share options x 10 grant price. The number of shares acquired is listed in box 5. Ad Trade Cboe Mini Index options on Interactive Brokers professional platform.

On this page is an Incentive Stock Options or ISO calculator. Incentive Stock Option - After exercising an ISO you should receive from your employer a Form 3921 Exercise of an Incentive Stock Option Under Section 422 b. Ad Customizable options contract that cross margin the same underlying stock or index.

Ad Keep Your Finger on All Your Investments at All Time With Real Time Alerts on Your Options. Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022. The calculator is very useful in evaluating the tax implications of a NSO.

Exercising your non-qualified stock options triggers a tax. Your compensation element is the difference between the exercise price 25 and the market price 45 on the day you. Get Real Time Alerts on Any Active Put or Call Options Quickly Review Spreads.

This calculator illustrates the tax benefits of exercising your stock options before IPO. Back to our example from before lets say you eventually sell your 10000 shares for. Get ready to own your shares in the company youve helped build.

Please enter your option information below to see your potential savings. Exercise incentive stock options without paying the alternative minimum tax. For example a single person who has AMTI of 525000 will only have 72900 - 525000 -.

Ad Get the capital you need to exercise early. How much are your stock options worth. The stock price is 50.

For every 1 beyond the phase out amount the exemption amount is reduced by 025. Your basis in the stock depends on the type of plan that granted your stock option. On this page is a non-qualified stock option or NSO calculator.

Equitybee covers all costs including tax. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your. Cboe Mini Index Options available at IBKR for the lowest cost.

Download Smart Options Strategies free today to see how to safely trade options. Ad Fidelity Has the Tools Education Experience To Enhance Your Business.

Taxation Of Stock Options For Employees In Canada Madan Ca

How Stock Options Are Taxed Carta

When To Exercise Stock Options

Chain Discount Calculator Template Excel Xlstemplates Discount Calculator Excel Templates Financial Management

How Much Are My Options Worth Eso Fund

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-03-4346254c24b54206b3dda8692d4f0f7c.jpg)

Employee Stock Option Eso Definition

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

Get The Most Out Of Employee Stock Options

Net Exercising Your Stock Options

Stock Options 101 The Essentials Mystockoptions Com

Budget 2019 Revised Section 87a Tax Rebate Tax Liability Calculation Illustration Income Tax Tax Deductions List Tax Deductions

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Option Eso Definition

How Stock Options Are Taxed Carta

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options